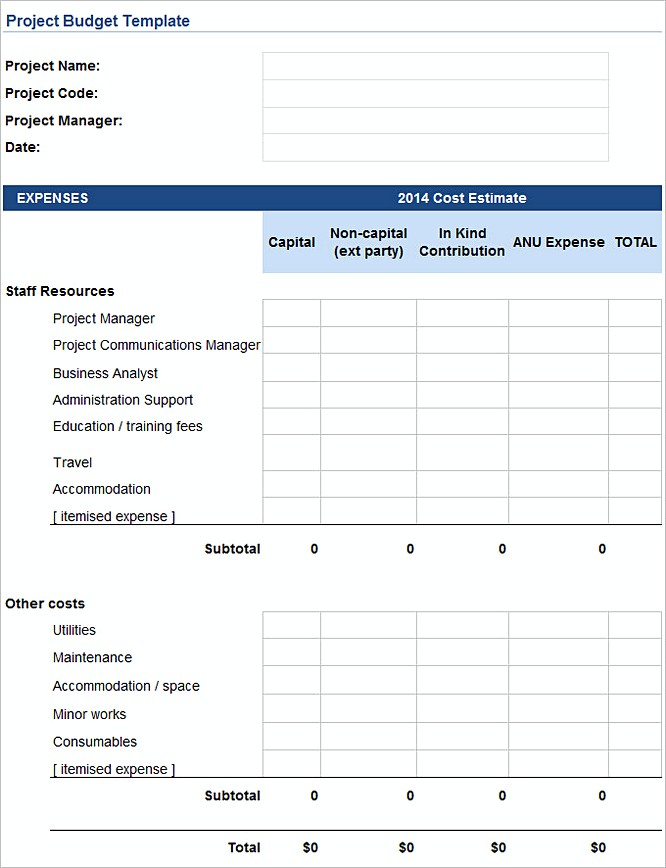

The Programme Based Budget is prepared specifically for a single project. The various benefits of a program-based budget are listed below: 1. It also helps in evaluating the program’s output and effectiveness through various performance metrics. The program-based budget provides detailed information about the program’s total cost and the revenues generated through the proposed program. It takes into account the difference between the program’s funding levels and the expected results in that proposed program, along with other factors like raw materials costs, natural resources, staff costs, equipment, etc. The program-based approach of budgeting, as the name implies, is prepared to keep in mind the goals and objectives of a specific program or project. The system was then called PPBS or the Planning, Programming, and Budgeting System. The programme based budgeting was first introduced by US President Lyndon Johnson in collaboration with the State Secretary of Defense, Robert S McNamara, in 1949. Programme based budgeting is an important budgeting tool that gives out all the budgetary information about every program that would be carried out with a budget. A well- planned approach for preparing performance and programme based budget helps you to eliminate unnecessary expenditures like penalties, late fees, and interests, which undoubtedly results in adding up some extra incomes in the future.Adhering to a budget helps you to set aside a particular portion of the income for unexpected and emergency costs without compromising the main heads of expenditure.An effectively planned budget process helps you to gauge what you can afford and what you can’t at the end of a month, you know where your money went and what else can you afford if there are any savings.A finance budget gives you more control over your money.Budgeting helps you to prioritize your spending.Some of the benefits of budget preparation are listed below:

The importance of budgeting lies in fact, how well the budget has been planned, taking into account all the important aspects of it. Before we delve into the basics of a programme based budgeting, let us begin with the benefits of traditional budgeting. There are many types of budgets Programme Budgets are just one of them. It helps you determine whether you have enough finance to do things you want and whether you will save anything from it. Budgeting helps you to balance your expenses against your incomes.

#Budget planning program how to

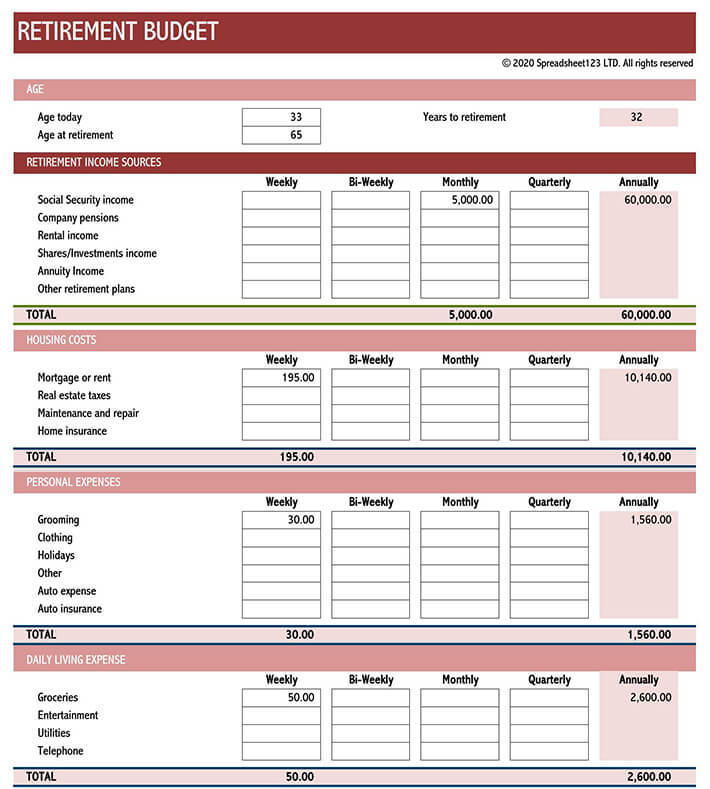

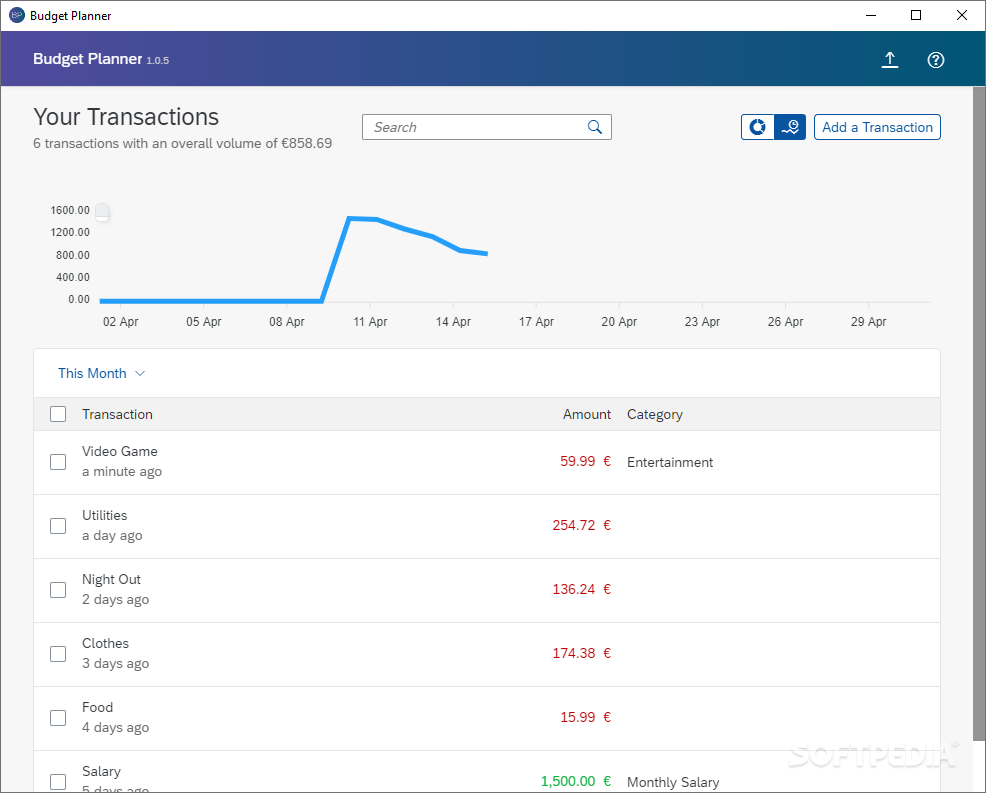

Generally, the closer you stick to your budget, the more progress you will make on your financial plan.Budgeting, in simple terms, is the process of creating a plan on how to spend your money. With a budget, you record your income and expenses on a weekly or monthly basis. With a financial plan, you typically track your progress on a quarterly or semi-annual basis. However, having a grasp on how much money to budget once your expenses are paid lets you know how much money can be put toward the goals defined in your financial plan. A good financial plan may address your income and expenses, taxes, insurance, estate planning, retirement, education needs, and other topics.Ĭreating a financial plan requires building a long-term strategy for getting you where you want to go, while building a budget means money management for the day-to-day.

While a budget helps you map out your key expenses and plan for the weeks and months to come, a financial plan allows you to set a course toward funding financial goals that are 5, 10, or 20 years down the road. Here are some key differences to help you distinguish between your budget and your financial plan: Yet, while the two go hand-in-hand, they are not the same. Financial plans and budgets can help you be financially successful now and in the future.

0 kommentar(er)

0 kommentar(er)